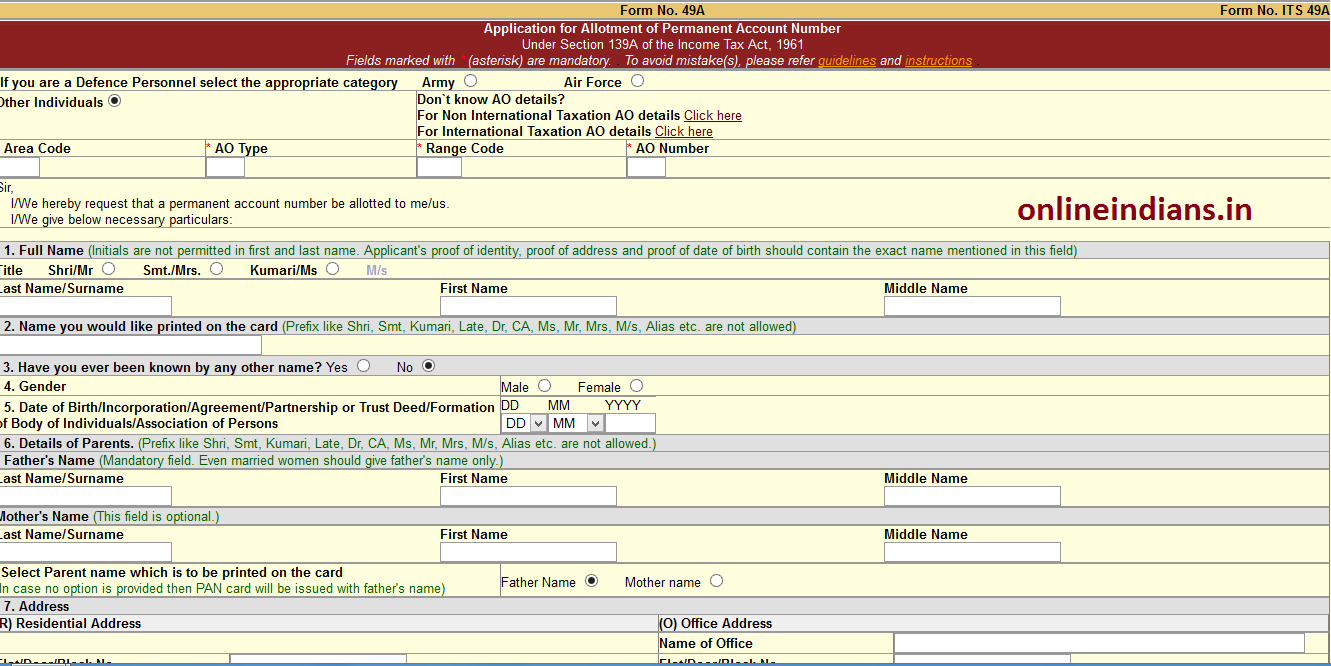

Download Form 49A Pan Application Form 49A In PDF Format: Are you new to PAN Card? Want to create one for you? Then you need to first download Form 49A and submit it via the official website of PAN. Using Form 49A, people, as well as legal entities, can get PAN card. PAN Card Form 49A – PAN Card Application Form 49a – Paisabazaar. The Income Tax Department NEVER asks for your PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts through e-mail. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card, bank and other financial accounts. 49A in Microsoft word format to apply for Permanent Account Number (PAN) I need a cerificate of identity or identity certificate letter format for pan card 2 Replies 1 Files. Unable to register employee for uan with out aadhar card.

- New Pan Card Application Form 49a In Word Format Free Download

- New Pan Card Application Form 49a Word Formatted

- New Pan Card Application Form 49a Word Format 2018

- New Pan Card Application Form 49a Word Format Download

- New Pan Card Application Form 49a Word Format Pdf

- New Pan Card Application Form 49a Word Format

As per income tax rules a person should have only one PAN number. If you have multiple PANs then you have to close the other PANs. If you are firm and not running your business anymore then also you need to close the PAN of that firm.

As per section 272B of the income tax act 1961, a penalty of 10,000 Rs can be levied if any one has more than One PAN.

How Can I Surrender my PAN Card

1. You can surrender your other PAN numbers either online or offline, but the offline process is more effective than the online process.

2. To surrender your other PANs which were not linked with any other services, you need to fill PAN correction form and in the field no .11 of this form you have to mention the other PAN numbers, which you want to surrender.

3. To surrender (or) cancel your currently using PAN / PAN of the firm you have to write a request letter to your local income tax assessing officer.

Here are some sample PAN card surrender letter formats for both individuals and firms, which you download them in Word format.

PAN Card Surrender Format for Individuals

To

The Income Tax Department,

Office name,

Address.

Sub: PAN card surrender request.

Respected Sir/Madam,

My name is ___________(your full name) writing this request letter to surrender my PAN card bearing number BUORR45678X.

I have been issued with Two PANs, I got my old PAN bearing no. FAXX 1245C long ago, but unfortunately I thought I lost it, and I applied for a new PAN.

But recently I have found my old PAN card, so I would like to close my new PAN card and continue with the old PAN. I have deregistered my new PAN number with all the services.

So kindly cancel my PAN card bearing no. BUORR45678X. I shall be grateful to you in this regard.

Thanking you.

New Pan Card Application Form 49a In Word Format Free Download

Yours faithfully,

Your name.

(Mobile no.)

PAN Surrender Letter Format for Partnership Firms

To

The Income Tax Department,

Office name,

Address.

Sub: PAN card surrender request of _______(firm name).

Respected Sir/Madam,

We the ____________(your firm name) requesting you to cancel our PAN bearing number ________(firm PAN no.).

We have shut down our business due to financial problems / tough competition / personal reasons/ partnership related problems. The shutdown has been done as per all the legal proceedings.

Hence our firm=m is no longer operating now, we would like to cancel the PAN of the firm.

So kindly cancel the PAN of our firm bearing number _______(firm PAN no.) and also find the enclosed copy of the PAN card.

New Pan Card Application Form 49a Word Formatted

Thanking you.

Yours sincerely,

Your name.

(Mobile no.)

PAN Card Surrender Letter After Death

It is better to cancel the PAN of the deceased persons. It is important to transfer the properties of the deceased person to his/her legal heirs.

If the deceased person is an income tax payer then the tax should be paid from the assets of the deceased person under the section 159 of income tax act 1961.

Letter Format

To

The Income Tax Department,

Office name,

Address.

Sub: PAN card cancellation request for late Sri/Smt_______(Deceased person name)

Respected Sir/Madam,

I am ___________(your name) legal heir of late Sri./Smt. _____________ writing this request letter to cancel the PAN of my deceased father/mother/husband bearing PAN number ________.(PAN no. of the deceased person).

His / Her IT returns have been filed up to the latest financial year and please find the enclosed copies of ITR payment receipts, death certificate, and legal heir certificate attached with this letter.

So kindly cancel the PAN of late Sri/Smt_____________(deceased person name) bearing PAN number ________.

I shall be obliged to you in this regard.

Thanking you.

Yours faithfully,

New Pan Card Application Form 49a Word Format 2018

Your name.

(Mobile no.)

After submitting the above request letters to the income tax department, collect the acknowledgement receipt.

FAQs

How many days will it take to surrender / cancel PAN ?New Pan Card Application Form 49a Word Format Download

15 days, from the date of submitting the request letter to the income tax office.

New Pan Card Application Form 49a Word Format Pdf

How can I check my PAN card surrender status?Step 1: Go to verify your PAN in the income tax website.

Step 2: Enter your PAN number, name, date of birth and mobile number.

Step 3: Now you will receive a OTP, and enter that OTP.

Step 4: Now the status of your PAN will be visible to you on the screen, it shows whether your PAN is active (or) inactive.

You can change your PAN number by filling a form at your bank (or) you can also do this through your bank’s internet banking portal.

New Pan Card Application Form 49a Word Format

Also Read